It seems straightforward to run an ambulatory surgery center from the outside: patients come in, procedures go smoothly, and everyone goes home the same day. However, underlying that smooth workflow is a money-making machine that never stops. One missed authorization, a forgotten modifier, or an ambiguous operative note can slow payments for weeks. That’s the moment ASC revenue cycle management stops being a “back-office function” and becomes the system that literally keeps your center alive.

Every ASC in the USA is battling the same storm—shrinking margins, intense payer scrutiny, and constantly changing rules. When billing steps slip out of sync, even high-performing centers start leaking revenue in places no one notices until month-end reports hurt. But when your financial engine becomes predictable, timely, and airtight, the entire operation feels lighter. This guide shows you how to create that kind of clarity.

What Is ASC Revenue Cycle Management?

ASC revenue cycle management is the interconnected process that tracks every dollar from the moment a patient is scheduled until the final payment hits your bank. It combines patient intake, eligibility checks, coding accuracy, claim submission, rejection follow-up, and appeal strategy into one smooth process. If done right, it stops underpayments, prevents unnecessary denials, and makes sure that ASCs get fully paid for the complicated procedures they perform.

Why ASCs Need Specialized RCM Instead of Standard Medical Billing

Ambulatory surgery centers have faster turnaround times, stricter payer requirements, and smaller margins than regular operations. They handle implants, various surgeons, bundled treatments, and payer-specific issues that traditional billing teams frequently overlook. That’s why specialized teams using ASC billing and coding services consistently outperform general billers—they know implant rules, ASC-approved procedure lists, modifier nuances, and Medicare’s unique ASC payment logic. Without that expertise, revenue leakage becomes unavoidable.

How ASC Billing Differs from Hospital & Physician Billing

ASC billing blends elements of both facility billing and professional billing, yet it follows its own rules. ASCs must apply CPT/HCPCS codes, manage device reimbursement, and navigate inconsistent payer policies. Hospitals use DRGs, while physicians bill individually—ASCs must master both worlds to stay profitable.

For ASC-specific payment policy details, see the CMS ASC Payment System:

Key Challenges in ASC Billing & Coding

ASC billing and coding services often encounter obstacles due to their flawless execution, which is crucial for ASC financial performance. Every claim must reflect precise documentation, correct CPT/HCPCS usage, and payer-aligned rules. Without a consistent workflow, ASC billing services face slowdowns that quietly drain revenue and disrupt operational efficiency.

Common Denials & Coding Errors in ASC Claims

Denials often stem from tiny gaps—missing operative note specifics, inconsistent anatomy descriptions, or mismatched laterality modifiers. Medicare and commercial payers flag anything unclear. Regular audits, pre-submission reviews, and real-time scrubbing help eliminate these errors before claims ever leave your system.

Why Payer-Specific Rules Make ASC Revenue Cycle Management Difficult

Each payer follows its rulebook. Some payers impose caps on implants. Some bundle procedures differently. Others require modifier-dependent medical necessity proof or limit the number of reimbursable codes per visit. ASCs that don’t adapt quickly face lower reimbursement and longer A/R cycles. Mastering these rules is the backbone of solid ASC revenue cycle management.

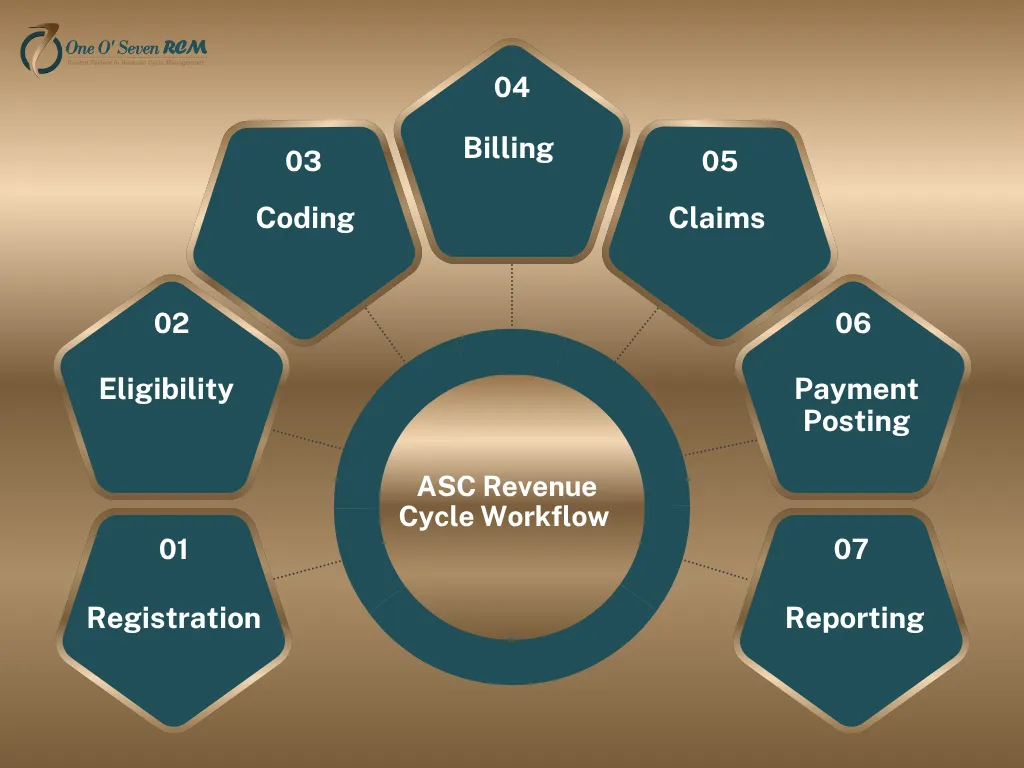

Core Components of a Successful ASC Revenue Cycle

A healthy ASC financial system relies on a chain of precise processes. When intake, authorization, coding, billing, and denial recovery operate in sync, revenue becomes predictable and stable.

Patient Intake, Insurance Verification & Prior Authorization

Most denied ASC claims fail before a patient even arrives. Incorrect demographics, inactive plans, missing referrals, or skipped authorizations instantly destroy reimbursement chances. Real-time verification tools, pre-op checks, and proactive authorization tracking preserve revenue before claims even begin their journey.

Compliance, Correct Coding (ICD-10, CPT, HCPCS), & Documentation

Every ASC depends on accurate ICD-10 selection, CPT/HCPCS coding, and crystal-clear operative notes. A single missed detail can cause downcoding or bundling. Compliance-first workflows keep ASCs aligned with Medicare guidelines, ASC-approved lists, and payer-specific documentation requirements.

For reference on payment differences across outpatient sites, see the AMA resource:

Claim Submission, Payment Posting & Denial Recovery

Speed and accuracy determine the strength of your cash flow. Clean claims mean faster payments; structured follow-up means fewer write-offs. ASCs that track patterns and enforce appeal templates reclaim significantly more revenue than centers that rely on passive follow-up.

Learn more about denial handling at

How Specialized ASC Billing Services Improve Revenue

Partnering with experts lifts the entire financial structure of your ASC. Teams offering ASC medical billing services bring consistency, accuracy, and razor-sharp insight into payer behavior.

Reducing AR Aging & Speeding Up Collections

Experts monitor aging claims daily, escalate high-value encounters quickly, and attack denials before they turn into write-offs. This keeps A/R days low and cash flow strong.

Using Correct Modifiers & Preventing Bundling Issues

ASC-specific modifiers—50, 59, 73, and 74—directly influence reimbursement. Misusing even one leads to instant downcoding. Strong workflows and regular training protect your revenue from preventable mistakes.

ASC Revenue Cycle Management Strategies

Advanced strategies make your center more resilient to shifting payer behavior. These steps tighten weak spots in your workflow and help boost your long-term margin.

Clean Claim Rates, Code Audits & Real-Time Error Detection

High-performing ASCs maintain clean claim rates above 94%. They do this with real-time edits, code audits, and denial-prevention tools. Early error detection ensures predictable revenue.

Contract Negotiation & Payer Policy Compliance

Payers adjust coverage rules frequently. Regular contract reviews, fee schedule updates, and payer policy monitoring protect ASCs from silent underpayments and missed opportunities.

2025 ASC Performance Benchmarks

| Metric | Strong Benchmark | Red Flag Indicator |

| Denial Rate | < 6% | > 10% |

| A/R Days | < 30 days | 40+ days |

| Clean Claim Rate | 94%+ | < 85% |

| Net Collection Rate | 96%+ | < 90% |

ASC RCM Performance Benchmarks for 2025

Monitoring performance data shows where revenue leaks, slows, or stops. ASCs that measure the right numbers consistently outperform those that rely on guesswork.

Ideal Denial Rates, A/R Days & Clean Claim Percentages

Centers hitting denial rates under 6%, A/R under 30 days, and clean claims above 94% consistently operate with healthier revenue cycles and cleaner compliance records.

Measuring Financial Leakage & Missed Reimbursement Opportunities

Leakage hides in outdated fee schedules, ignored underpayments, miscoded implants, and missed modifiers. Tracking these areas monthly transforms your financial forecasting power.

Common Sources of ASC Financial Leakage

| Revenue Leak Source | Example | Impact |

| Missed Modifiers | 59, 73, and 74 are unused | Downcoding |

| Implant underbilling | Missing HCPCS code | 10–40% loss |

| Incorrect Bundling | Wrong CPT pair | Claim reduction |

| Payer Underpayments | Silent reductions | Long-term loss |

Why Outsourcing ASC Revenue Cycle Management Works

Outsourcing removes staffing gaps, training issues, and slow follow-ups. It gives ASCs a consistent system supported by specialized teams.

In-house vs. Outsourced ASC Billing: Cost, Speed, and Accuracy

In-house teams juggle multiple roles. Outsourced teams handle coding, compliance reviews, payer tracking, and aggressive follow-up. The difference shows up in A/R days, denial trends, and month-end revenue stability.

How One O Seven RCM Supports ASC Billing

One O Seven RCM strengthens ASC workflows with structured coding, deep compliance logic, and targeted denial recovery models. Their scalable solutions adapt to ASC growth, evolving payer demands, and new 2025 regulatory expectations—ensuring long-term billing stability.

Final Thoughts: Strengthening Your ASC Revenue Cycle Management

A thriving ASC depends on disciplined processes, proactive audits, and compliance-driven accuracy. When each step in the revenue cycle aligns, your financial performance becomes predictable, transparent, and scalable—regardless of payer changes.

Actionable Takeaways for Administrators

Stay updated on payer rules, audit claims weekly, maintain strict documentation, and benchmark performance quarterly. These habits prevent leakage and protect margins.

Talk to an ASC RCM Expert

Ready to strengthen your ASC’s financial performance? One O Seven RCM can help you build a cleaner, faster, and more predictable revenue cycle—without overwhelming your administrative team.

Frequently Asked Questions about ASC Revenue Cycle Management

1. What does ASC mean in medical billing, and how does it work?

An ASC is an Ambulatory Surgery Center that bills for outpatient surgeries using CPT/HCPCS codes, facility fees, and regulations for how payers will pay.

2. What will ASC billing cover in 2025?

When you get surgery on the same day, ASC billing comprises coding, entering charges, checking insurance, sending in claims, managing denials, and posting payments.

3. What are the most typical mistakes people make while billing ASC?

The most common problems are wrong modifiers, missing paperwork, billing flaws for implants, and payer-specific bundling mistakes that lead to denials that could have been avoided.

4. How does managing the ASC revenue cycle help with being paid?

ASC RCM increases reimbursements by making sure that every claim fulfills payer compliance criteria, tightening coding accuracy, lowering AR days, and stopping denials.

5. Why is billing for ASC more complicated than billing for doctors?

ASCs have to follow both facility and professional billing regulations, take care of implants, and deal with a lot of different payer policies. This makes billing for ASCs more complicated than billing for regular medical services.