Behavioral Health Revenue Cycle Management matters most when your day already feels full. Denials rise for reasons that rarely make sense. Notes take longer than the session itself. Payers question valid treatment plans. Staff chase authorizations instead of focusing on patients. You feel the pressure in cash flow long before the reports confirm it. The work is clinical, but the losses are financial, and both collide at the worst time.

A strong revenue cycle gives you a way out. It brings order to documentation. It aligns sessions with payer logic. It speeds up reimbursement without adding more tasks to your day. Most importantly, it protects the revenue your team has already earned so you can focus on care instead of recovery work.

Why Behavioral Health Claims Fail Before They Reach the Payer

Most claims do not fail at coding. They fail because Behavioral Health Revenue Cycle Management depends on documentation, authorization, and session logic that rarely match what payers expect. Even strong clinical work gets delayed when the billing process does not mirror the way each payer reviews behavioral health services. The revenue loss begins long before the denial shows up.

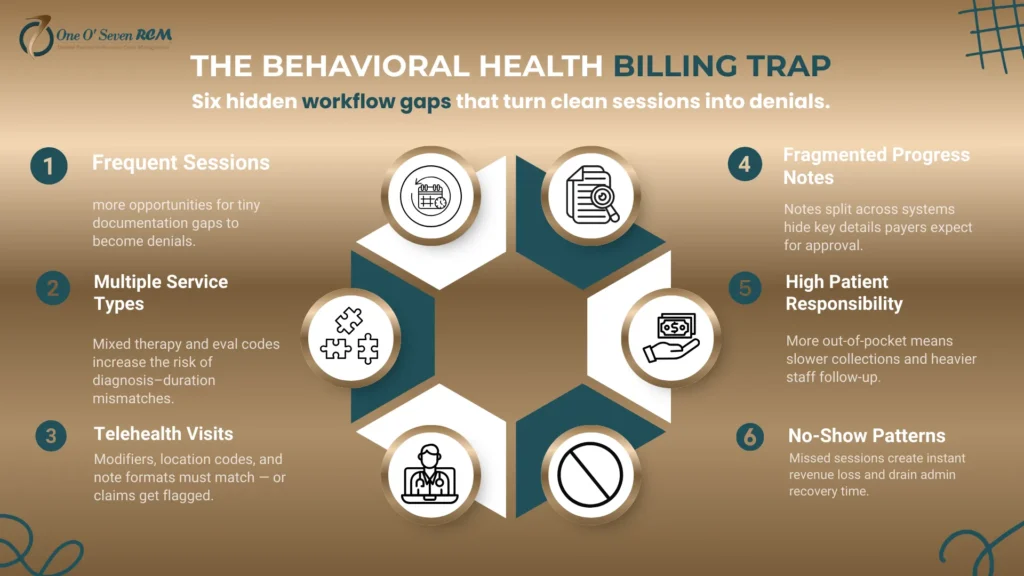

The Behavioral Health Billing Trap

1. Frequent Sessions Create More Chances for Small Gaps to Become Denials

Frequent sessions create more touchpoints where small documentation gaps add up.

2. Multiple Service Types Increase Coding Pressure

Different service types in the same week increase the chances of a mismatch between diagnosis, duration, and medical necessity.

3. Telehealth Visits Add Another Layer of Payer Complexity

Telehealth variations cause inconsistencies when notes, modifiers, or location codes are not aligned.

4. Fragmented Progress Notes Slow Down Clean Claims

Notes spread across systems make it easy for key details to be missed when payers review the claim.

5. High Patient Responsibility Pushes More Work to an Already Stretched Staff

When patients owe more, collections slow down and staff spend more time following up.

6. No-Show Patterns Hit the Revenue Cycle Immediately

The financial impact lands instantly, while the administrative recovery drains time and attention.

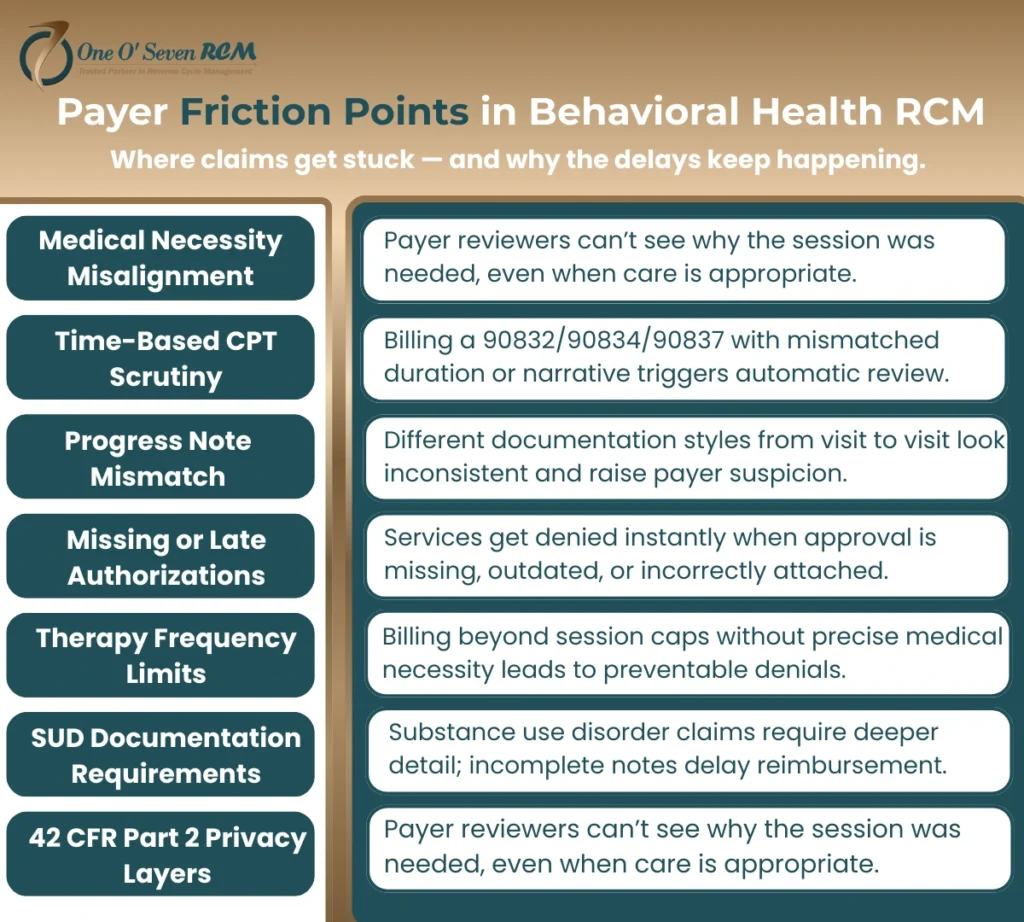

The Payer Friction Points Nobody Warns You About

1. Medical Necessity Misalignment Blocks Clean Claims

Payers deny behavioral health claims when the note does not clearly explain why the session was needed. Even strong clinical care gets pushed back when the language in the progress note does not match the criteria used by the payer.

2. Time-Based CPT Scrutiny Catches Small Documentation Gaps

Sessions billed under time-based CPT codes face tighter review. If the narrative, duration, and clinical need do not support the exact time billed, claims stall or are denied even when treatment was appropriate.

3. Progress Note Mismatch Creates Preventable Delays

Behavioral health documentation often varies between clinicians. When style, detail, or structure changes from one visit to the next, payers flag the inconsistency and question the pattern of care.

4. Missing or Late Authorizations Stop Reimbursement Immediately

Authorizations control large portions of behavioral health care. When approval is missing, outdated, or not linked correctly to the session, denials hit fast and recovery takes weeks.

5. Therapy Frequency Limits Cause Unexpected Denials

Many payers restrict how often certain therapy codes can be billed. Exceeding the limit even by one visit can trigger an automatic denial unless medical necessity is documented with precision.

6. Substance Use Disorder Documentation Requires Higher Detail

SUD claims demand clearer justification, more structured notes, and consistent follow-up. Even minor gaps in documentation create delays because these services undergo deeper payer review.

7. Privacy Layers Under 42 CFR Part 2 Influence Billing Flow

Substance use disorder privacy rules add another layer of complexity. When documentation is separated or redacted incorrectly, billing teams struggle to meet payer requirements without violating federal protections.

The Behavioral Health AR Crisis

1. Documentation Delays Slow Down the Entire Revenue Cycle

When notes are completed late or lack the exact detail a payer needs, claims sit untouched. Each day of delay increases AR and pushes payment further into the future.

2. Clearinghouse Loop Errors Create Hidden Bottlenecks

Behavioral health claims often get stuck between EHR and payer systems. Loop errors build silently, and teams only notice when the aging report exposes a backlog that should never have reached that stage.

3. Missing Modifiers Trigger Automatic Denials

Without accurate modifiers for telehealth, location, or service type, payers deny claims instantly. Behavioral health relies heavily on these details, and even one missing modifier can disrupt the entire week’s revenue.

4. Incorrect CPT Sequences Break Claim Logic

Behavioral health sessions vary in length and complexity. When CPT codes are sequenced incorrectly or paired with unsupported diagnoses, payers question accuracy and delay reimbursement.

5. AR Aging Quietly Without Provider Awareness

Aging accounts do not reveal themselves immediately. They build in the background while teams focus on new visits. By the time the issue surfaces, the recovery window is already shrinking.

6. Staff Overworked on Rework Instead of Prevention

Teams spend hours fixing preventable errors instead of strengthening the workflow that caused them. Rework drains energy, slows claim cycles, and increases burnout across administrative staff.

The Behavioral Health RCM Master Framework

Behavioral Health Revenue Cycle Management only works when every step from scheduling to payment is aligned with payer logic and clinical workflow. This nine-part system is built for behavioral health organizations that need clean documentation, accurate coding, and predictable reimbursement without overwhelming their staff.

Step 1—Pre-Visit Financial Clearance

Financial clearance sets the tone for the entire claim. Insurance is verified before the visit so your team knows exactly what the payer will approve. Authorization logic is checked early to avoid treatment delays. Medical necessity expectations are confirmed against the diagnosis and planned service. The session type is matched to the benefit structure to prevent frequency or duration conflicts. Patient responsibility is made clear so the front desk can collect with confidence.

Step 2—Documentation and Coding Accuracy Layer

Behavioral health documentation must be unambiguous. CPT codes such as 90791, 90792, 90832, 90834, 90837, 90853, and H codes are paired with diagnoses that support the treatment plan. Each note reflects the time spent, the method used, and the clinical need. Crisis sessions and group therapy require additional detail. Substance use disorder visits must meet higher documentation standards. This accuracy removes ambiguity during payer review.

Step 3—Clean Claim Integrity Check

Before any claim is sent, it is checked for structural accuracy. Claim scrubbing identifies missing fields. Frequency edits ensure that session counts do not exceed payer limits. Credential mapping confirms that the clinician is authorized to provide the service. Diagnosis and CPT alignment are reviewed to avoid mismatches. Authorization codes are attached correctly so the claim flows through the system without interruption.

Step 4—Submission Timeline Control

A clean claim still needs a controlled submission process. Clearinghouse workflow is monitored so no claim stalls in transmission. Real-time status tracking confirms when the payer receives it. Submission audits prevent silent errors that accumulate in batches. Accelerated follow-up triggers ensure no claim ages past the point where payer outreach becomes costly and time-consuming.

Step 5—Denial Defense System

Denials are categorized immediately so patterns are visible. Appeal scripting helps staff respond with confidence and structure. Payer documentation templates give clinicians clear guidance on what payers expect. Root-cause tracking removes the guesswork behind repeated denials. Preventive coding improvements reduce future errors and stabilize cash flow.

Step 6—AR and Cash Flow Acceleration

AR is managed with a proactive strategy. Aging buckets reveal where revenue is stuck and guide timely follow-up. Payment posting accuracy prevents underpayments from hiding in the system. Underpayment detection flags missed revenue your team has already earned. Digital patient payments and automated reminders help recover balances without creating more admin work.

Step 7—Compliance Shield

Compliance protects the entire revenue cycle. HIPAA and 42 CFR Part 2 requirements guide documentation and information sharing. Audit preparation ensures notes and claims withstand review. Telehealth billing safety prevents location code or modifier errors. Privacy workflow alignment helps keep your practice protected while still moving claims forward.

Top 5 Behavioral Health Denial Reasons and Fixes

Behavioral Health Revenue Cycle Management reduces denials only when the root causes are addressed with precision. These five issues create most of the revenue loss in behavioral health.

| Denial Reason | Fix |

| Missing authorization | Verify approval before the visit and attach the code to the claim |

| Time mismatch | Match CPT duration with documented session time |

| Diagnosis not supported | Strengthen medical necessity language in progress notes |

| Incorrect CPT | Use specialty-appropriate codes with accurate sequencing |

| Payer session limitation | Document the clinical need for higher frequency or secure exceptions |

How a Behavioral Health RCM Partner Improves Revenue, Reduces Stress, and Restores Predictable Cash Flow

A specialized partner understands the operational, clinical, and payer nuances behind Behavioral Health Revenue Cycle Management. This insight turns daily billing pressure into a stable, predictable system that supports your team instead of exhausting it.

1. Specialists Understand Behavioral Health Documentation

Behavioral health documentation requires accuracy at a level many general billers never learn. A 90837 session is a clear example. If the note does not justify the duration, the payer questions the entire visit. When clinical language is vague or incomplete, denials rise even though the care was appropriate. A partner trained only in behavioral health understands how to match time, method, and clinical need so your claims pass on the first review.

2. Faster Payments Through Automation

Automation removes delays that manual billing creates. Claim scrubbing catches errors before submission. Integrated EHR workflows remove double entry. AI validation flags missing elements that cause denials. Real-time eligibility ensures staff know exactly what is covered before the visit. Behavioral health workflow triggers alert your team when a note, authorization, or modifier needs attention. These tools shorten payment cycles and protect revenue that would otherwise sit untouched.

3. AR Control With Predictable Recovery Timelines

Behavioral health AR moves differently from other specialties. Denials cluster around documentation, time-based codes, and prior authorization. A specially trained team knows how to read these patterns and address them quickly. Follow-up becomes structured instead of reactive. Payment posting is precise, so underpayments do not hide in the system. This creates a predictable flow of recovered revenue instead of long gaps that unsettle leadership.

4. Lower Staff Burnout

When RCM workflows function correctly, administrative pressure drops fast. Staff no longer verify insurance manually or chase payers for basic answers. Progress notes stop bouncing back for small corrections. Claims stop piling up in rework queues. This allows your team more time for patients and fewer hours spent correcting preventable errors.

5. Better Patient Experience Leads to Higher Collections

A smooth billing process helps both the practice and the patient. Digital statements show balances clearly. Copay expectations are explained before the visit, not after. Text reminders reduce missed payments. Online portals let patients pay easily. These small improvements create consistent collections and reduce the need for repeated outreach.

Your Claims Don’t Need to Keep Bleeding Revenue

If you are losing revenue without knowing why, a free Behavioral Health RCM Audit can show you exactly where documentation, coding, and authorization misalignment are slowing payments and creating preventable denials. The audit highlights the specific steps that will stop leakage quickly so your team can focus on care instead of chasing unresolved claims.

Many practices compare the cost of lost revenue to the cost of support. Our service rate is 2.29 percent for full-cycle Behavioral Health Revenue Cycle Management, and in most cases it is lower than the financial impact of in-house billing errors, staff turnover, and the time required to manage payer follow-up. This clarity helps providers make decisions based on actual numbers rather than assumptions.

Expert’s Note—Why BH Claims Are Scrutinized More Than Any Other Specialty

Behavioral health claims face higher payer scrutiny because progress notes, session duration, and authorization logic vary by clinician and by treatment type. The practices that see consistent reimbursement unify documentation, coding, and payer requirements inside one organized Behavioral Health Revenue Cycle Management system. This alignment prevents confusion and protects the revenue your clinicians earn.

Weekly Behavioral Health RCM KPIs Every Practice Should Track

- Clean claim rate

- First-pass acceptance

- Days in AR

- Denial rate by category

- Underpayment percentage

- Authorization turnaround

- No recovery impact is shown

These metrics reveal the health of the entire revenue cycle and guide weekly adjustments that improve cash flow.

Frequently Asked Questions About Behavioral Health Revenue Cycle Management

1. What makes behavioral health billing different?

Behavioral health billing demands more precision than most specialties. Notes must be clear, detailed, and tied to measurable clinical goals. Time-based CPT coding must match the exact duration of the session. Medical necessity must be documented in language that aligns with payer criteria. Small gaps in any of these areas can delay or block reimbursement.

2. Why are behavioral health denials higher?

Denials increase when session length is unclear, diagnoses are not supported, or authorizations are missing. Behavioral health claims face closer scrutiny because treatment patterns vary, and payers look for strict consistency between notes, CPT codes, and clinical reasoning.

3. How can practices improve clean claims in behavioral health?

Clean claims depend on three foundations. Documentation must match CPT duration. Authorizations must be confirmed before the visit. Medical necessity must be clear in every note. When these elements align, claims move through review without friction, and denials drop sharply.

4. Do behavioral health services require prior authorization?

Many do. Therapy visits, evaluations, and medication management often need prior authorization. Requirements change by payer, plan type, and diagnosis, so verification must happen before the patient arrives. This prevents treatment delays and protects reimbursement.

5. What documentation lowers behavioral health denials?

Strong documentation includes clear goals, measurable progress, accurate time tracking, and a tight link between diagnosis and CPT selection. When the narrative reflects what happened in the session with no gaps, payers have no reason to question the claim.

6. How long until revenue improves with better RCM processes?

Most practices see improvements within weeks once documentation, authorizations, and coding follow a structured workflow. Preventable denials drop first, followed by cleaner AR and faster payments. Small changes compound quickly in behavioral health.

7. How do you know when it is time to outsource behavioral health RCM?

It may be time when claims age without explanation, staff are burned out from rework, or denials repeat the same pattern. When internal teams no longer have the time or capacity to investigate the causes, a specialized partner brings clarity and restores stability to the revenue cycle.

Predictable Revenue Without Extra Work

A stable revenue cycle gives your practice room to breathe. It creates clearer cash flow, fewer denials, cleaner documentation, and a calmer daily workflow. It reduces payer conflict and frees your team to focus on patient care instead of administrative recovery.

Talk to a Behavioral Health RCM specialist from One O Seven RCM if you want a clearer path to reliable payments. Our service rate is 2.29 percent, and you receive full-cycle support designed specifically for behavioral health without pressure or long-term commitment.